The Bank of Canada recently announced an increase in its key rate, in March 2022. So some people are panicking and asking questions about their mortgage: what do we do now? Do we renew or do we wait? Do we have to buy 20 lb of toilet paper?

But above all, what will happen if you have a variable rate? What do we choose in 2022 as the mortgage rate? Fixed or variable rate? Let’s see the differences together.

What is a fixed rate?

A fixed rate, you guessed it, is a mortgage rate that never changes for the entire term, generally 1 to 5 years.

What is a variable rate?

Unlike the fixed rate, the variable mortgage rate – yes, you are perceptive – is changing during the term of the loan, that is to say, it varies according to the key rate. This key rate, from the Bank of Canada, impacts the prime rates of banks. These are the ones that dictate your rate. The key rate can potentially change up to 8 times a year.

So far, how are you? You have questions? No? Perfect, let’s continue.

What to choose?

Naturally, there are pros and cons on both sides.

Advantages of the fixed rate

- You avoid unpleasant surprises.

- You can rest easy without having to think about your mortgage.

- You benefit from better planning of your budget.

Disadvantages of the fixed rate

- Since the rate does not change during the entire loan, you cannot take advantage of down periods in the market.

- Fixed rates are generally higher since banks consider the cost of borrowing funds over a longer period. Since they take a greater risk, it is normal that they charge you a higher rate. They therefore guarantee a certain return.

- Penalties are considerably higher with a fixed rate.

Advantages of the variable rate

- Less expensive over the long term; you benefit from the best possible rate from the start.

- In the event of a drop, your mortgage payment goes down. Paying less is always good, right?

- The penalties are much lower, equivalent to only 3 months of interest.

Disadvantages of the variable rate

- Not recommended for people who tend to be financially anxious and who have less tolerance for risk.

- It is more difficult to budget.

What is a fixed rate?

If you want peace of mind, and don’t want to stress, go with a fixed rate. However, be aware that you can save a lot more in the long term with a variable rate, which happens to be a very well-controlled risk.

Did you know that the 5-year fixed rate is the most popular rate in Canada and almost 7 out of 10 loans will not complete this type of term? The lender ensures the guaranteed return. If you do not respect your commitment, he claims part of the return not obtained in the form of a penalty. So he cashes in a portion of the future return and now has new funds to lend.

Extra tip 1:

Don’t play on the limit of your budget; make sure you have money on hand regardless of the loan.

Extra Tip 2:

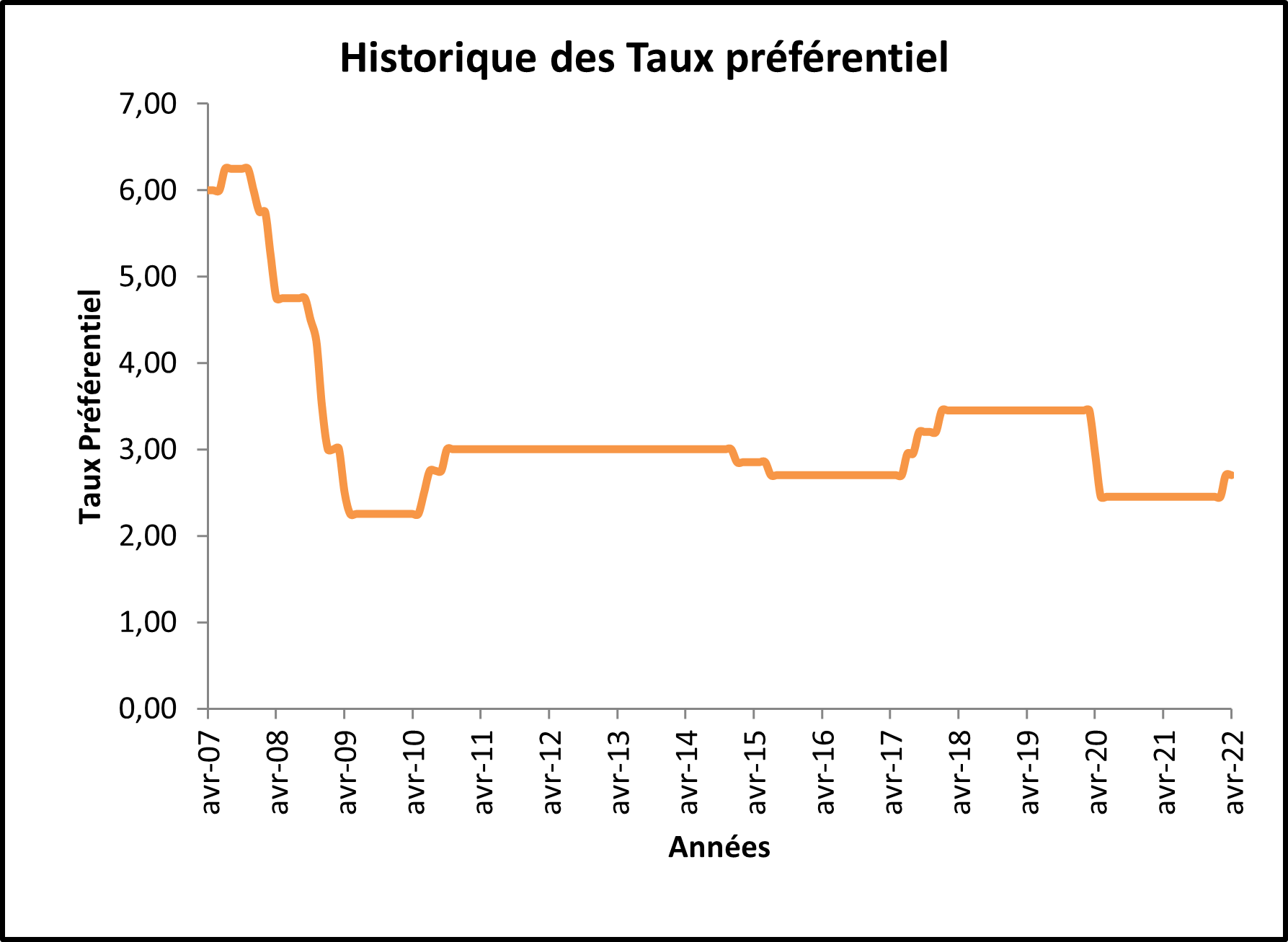

If you’re worried about rate hikes, know that the policy rate goes up, yes, but never by much at once. In fact, if we look at the following graph (Table 1.1), we see a significant drop in 2007, following the recession of American banks. It stabilized thereafter, we saw a slight increase until the pandemic in April 2020. Then, due to COVID-19, there was a further significant drop. Since 2022, we have experienced a slight upward correction in rates.

Find the mortgage rate you deserve

When the time comes to find your next mortgage rate, whether you want it variable or fixed, trust the experts.

Nicolas Ouimet – that’s me – guides you through the most important transaction of your life. Do you need my services? You have questions? Contact me!